— 12 min read

Pro Forma Explained: How Construction Developers Predict Financial Success

Last Updated Aug 14, 2024

Nina Pryor

Senior Solutions Engineer

Nina Pryor is a Senior Solutions Engineer at Procore. She previously worked in construction consulting and project management for several developers from Los Angeles to New York, including WeWork, CBRE, and Turton Bond. Before diving into construction, Nina worked as a financial analyst for JPMorgan Chase. She lives in Los Angeles.

Taylor Riso

Contributing Writer

95 articles

Taylor Riso is a marketing professional with more than 10 years of experience in the construction industry. Skilled in content development and marketing strategies, she leverages her diverse experience to help professionals in the built environment. She currently resides in Portland, Oregon.

Last Updated Aug 14, 2024

Understanding the financial nuances of construction projects requires a deep dive into forecasting, planning and financial evaluation to determine a project's success and profitability. In this challenging financial environment, pro formas play a critical role, serving as key tools for financial guidance.

This article aims to demystify pro formas in construction, outlining their structure, significance and how they can be used to predict and enhance financial outcomes of construction projects. By having a clearer understanding of pro formas, general contractors can gain insights into what is important to owners, facilitating comprehensive planning, risk assessment, and the securing of funding.

Table of contents

Pro Forma Basics

A pro forma is a financial model or analysis designed to evaluate the feasibility of a project from a financial standpoint. This process allows developers and project managers to dive deep into the financial intricacies of a proposed construction project. By laying out expected revenues, costs, and the overall financial roadmap, a pro forma provides a crucial snapshot of the project’s potential profitability. This financial foresight is invaluable, particularly when deciding whether to move forward with a development.

From the perspective of acquisition teams or real estate professionals, pro formas serve as forecasting tools and a detailed financial roadmap that guides decision-making. By quantifying the economic viability of a project, these documents answer the critical question of whether a project makes fiscal sense to pursue.

In essence, pro formas offer a clear financial picture, enabling stakeholders to make informed decisions about project feasibility, resource allocation, and potential financial outcomes. This level of analysis is fundamental in ensuring that any development project pursued is more than just an idea but also a secure financial venture.

Examples & Templates

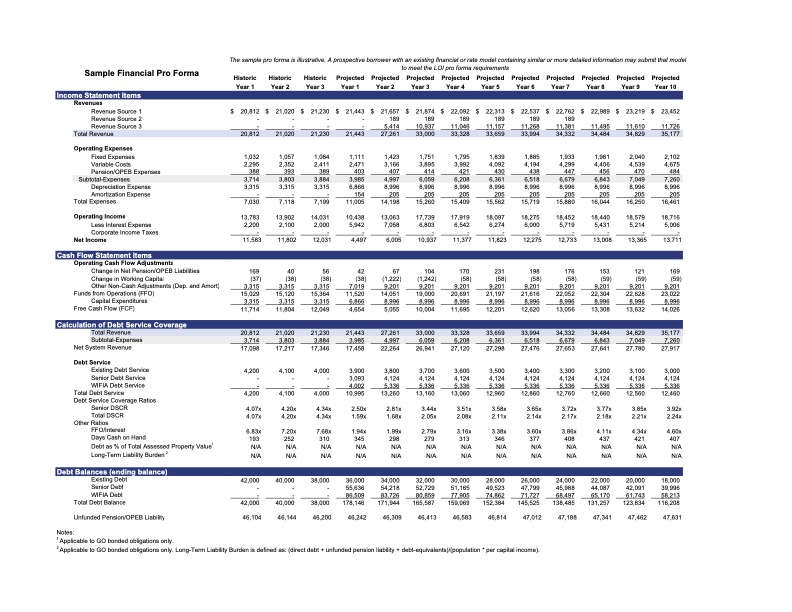

The US EPA offers several pro forma templates for developers to use in their application for federal funding of qualifying projects.

Sample Financial Pro Forma (PDF)

This pro forma spreadsheet shows historical and projected revenue and costs over a 10-year period for a sample project, including:

- Income statement account balances

- Cash flow statement

- Debt service calculation

- Debt balances

Key Components of a Pro Forma

A comprehensive pro forma document encompasses several components that together provide a detailed financial overview of a construction project's financial health and viability.

Revenue Projections

The cornerstone of any pro forma is the revenue projection. This section estimates the anticipated income from the project, considering factors such as market demand, pricing strategies, and the potential sales timeline. Revenue projections are based on thorough market research and analysis, offering a forecast of how much money the project is expected to generate over time. This involves a careful examination of similar projects, current market trends, and economic conditions to ensure precision and practicality in the forecasts.

Cost Projections

Equally important as forecasting revenue is a detailed breakdown of expected costs. This includes direct costs like materials and labor as well as indirect costs such as overhead, permitting fees and any other administrative expenses. Cost projections require a granular analysis of every aspect of the construction process, encompassing predevelopment phase expenses like feasibility studies and soft costs including architectural and engineering fees, extending from initial site work through to final finishes. By accounting for these expenses upfront, developers can better manage budgets and mitigate the risk of cost overruns.

Financing Information

This section outlines the assumptions regarding loans, equity contributions, and any other forms of financing. It includes the terms of financing, interest rates, repayment schedules and equity distribution among investors. Clear financing details help in assessing the project's financial feasibility and illustrating how funding gaps will be bridged throughout the development process.

Cash Flow Analysis

A pro forma's cash flow analysis reveals the timing and magnitude of cash inflows and outflows across the project lifecycle. This analysis is vital for ensuring liquidity, managing financing costs, and planning for contingencies. It helps stakeholders understand when the project will require cash injections and when it is expected to generate cash surpluses. A well-crafted cash flow projection can help prevent liquidity crunches and inform strategic decision-making.

Profitability Metrics

Pro formas also include several key profitability metrics such as Internal Rate of Return (IRR) and Return on Investment (ROI). These metrics provide a quantitative basis for evaluating the financial attractiveness of a project.

IRR represents the project's expected rate of return, helping investors compare it against alternative investments. ROI measures the efficiency of the investment, indicating the percentage return on the invested capital.

Together, these metrics offer a comprehensive view of the project's potential profitability, guiding investors and developers in their decision-making process.

Schedule

A construction project’s timeline directly influences financial projections and overall project feasibility. The schedule outlines key milestones and phases of the project, from groundbreaking to completion, including critical path activities that could impact the project's duration.

A well-planned schedule helps in identifying the sequencing of tasks, the duration of each phase and the allocation of resources over time. This outline is essential for coordinating project activities, managing stakeholder expectations, and ensuring timely completion.

In the context of pro formas, the schedule is intertwined with cost and revenue projections, as the timing of expenditures and income flows are pivotal for cash flow analysis and the assessment of financial viability. A detailed and realistic schedule allows for the synchronization of financial planning with the physical progress of construction work.

Operating & Maintenance Expenses

Beyond the initial development costs, pro formas must also consider the long-term operating and maintenance (O&M) expenses that will accrue over the lifespan of the building. These expenses encompass the day-to-day costs of running the facility, including utilities, janitorial services, repairs, and routine maintenance.

Additionally, they account for periodic major maintenance or replacement costs, such as HVAC systems, roofing, and exterior painting. Accurately forecasting these expenses is crucial for providing a comprehensive financial picture, ensuring that project owners and investors understand not just the capital expenditure required to bring a project to fruition but also the ongoing costs necessary to maintain its value and functionality.

Including O&M expenses in pro formas allows stakeholders to assess the total cost of ownership, facilitating more informed investment decisions and financial planning for the sustainability and profitability of the project.

The Importance of Pro Formas

Pro formas are not merely financial models but serve as strategic tools that guide decision-making from due diligence and feasibility studies to the conceptual phase to closeout and beyond.

Risk Assessment & Management

Construction projects are inherently risky, with variables such as market fluctuations, material costs, and unforeseen delays which all affect the bottom line. Pro formas allow project stakeholders to anticipate these risks by providing detailed financial models and plan for them.

This foresight enables the identification and mitigation of potential financial pitfalls before they occur, ensuring that projects remain viable under a variety of different scenarios.

Financial Feasibility Analysis

Before breaking ground, project owners and investors need to know that their investment is sound. Pro formas offer a comprehensive analysis of the expected revenues, costs and profitability of a project, helping to determine its financial feasibility. By laying out the expected financial landscape and the variables that impact that landscape, a pro forma helps stakeholders decide whether a project is worth pursuing or, in other words, profitable.

Financial Planning & Control

A well-constructed pro forma is a living document that aids in the ongoing financial management throughout the entire development cycle. It sets benchmarks for expenditures and income, allowing for real-time comparisons as the project progresses. This ongoing analysis helps in maintaining control over the budget, ensuring that the project stays on track financially.

Securing Financing

Lenders and investors rely heavily on pro formas to assess the viability of a project. These documents provide a detailed projection of cash flows, demonstrating the project's potential to generate sufficient revenue to cover costs and return on investment. A solid pro forma can be the difference between obtaining necessary funding and a project never getting off the ground.

Cash Flow Management

Pro formas provide a detailed forecast of the project's cash inflows and outflows, enabling project managers and stakeholders to anticipate periods of cash surplus and shortage throughout the project's lifecycle. By meticulously outlining when expenses like labor, materials, and overhead will occur, alongside anticipated payments from clients or financing draws, a pro forma offers a clear picture of finances of a project at any stage.

Effective cash flow management, facilitated by a pro forma, ensures that a project has sufficient liquidity to meet its obligations on time, preventing costly delays or disruptions. It also allows for strategic planning for the use of any excess cash, whether it be reinvesting in the project, allocating it to other ventures, or managing debt more efficiently.

Transparency & Accountability in Public Projects

Pro formas take on heightened importance in public projects, where the use of public funds is under scrutiny. These documents provide transparency and accountability, meticulously detailing how every tax dollar is allocated and spent.

By providing a clear breakdown of costs, revenues, and the financial justification for each expenditure, pro formas ensure that public projects stand up to audits and meet stringent reporting requirements. They play a crucial role in demonstrating that public investments are managed effectively and with integrity, reinforcing public trust and confidence in the project's management.

This level of detail and openness not only satisfies regulatory and oversight demands but also underscores the commitment to using public resources wisely and efficiently.

Best Practices for Creating & Maintaining a Pro Forma

Review historical data.

Reviewing historical data when crafting a pro forma lays the groundwork for accurate forecasting and planning. This process involves a thorough analysis of past projects that are similar in scope and complexity, scrutinizing aspects of their financial performance, including costs, timelines, revenue generation, and profitability.

By delving into the successes and challenges faced by these projects, developers can glean invaluable insights and lessons learned into potential risk factors, realistic cost estimations, and achievable timelines. Furthermore, historical data helps in identifying market trends, economic conditions, and regulatory changes that could impact the current project.

Compare estimates vs. actuals.

Analyzing the variances between estimated and actual financial data is critical for improving the forecasting accuracy of pro formas. This step involves periodically reviewing the estimated financial figures outlined in the pro forma against the real costs and revenues accrued.

The comparison not only highlights variances between projected and actual figures but provides insight into the accuracy of the initial estimates. This practice aids in refining the accuracy of future pro formas by incorporating lessons learned from these variances, enhancing the reliability of financial forecasts and enabling better decision-making for subsequent projects.

Regularly performing this comparison fosters a culture of financial diligence and continuous improvement — crucial for success in the construction industry.

Recognize the financial ripple effect of project delays.

Recognizing the financial implications of project delays goes beyond merely acknowledging missed revenue when the project completion date slips; it involves the strategic foresight to secure additional capital for ongoing commitments, such as loan repayments.

When a project timeline extends unexpectedly, it's not just about the income that isn't being realized — it's also about managing the cash flow to ensure that financial obligations are met without disruption. This requires a proactive approach to financial planning, where contingency funds or alternative financial sources are identified early to cover any gaps caused by delays, ensuring that the project remains solvent and on a path to successful completion.

Lean on the expertise and knowledge of the entire project team.

Leveraging the expertise of consultants, who bring a wealth of knowledge from working across various project types and owners, is key to gaining insights into cost management and identifying potential obstacles early on. Similarly, fostering a culture of openness and partnership among the entire project team enhances collaborative problem-solving and support. This collective approach allows for the sharing of critical information that can influence project outcomes positively.

Additionally, involving the GC early in the preconstruction phase for cost estimating not only enhances the accuracy of the pro forma but also ensures that the construction budget is realistic and informed by on-the-ground insights, facilitating overall smoother project execution and financial management.

Dive deep into scenario analysis.

Incorporating a range of case scenarios, from the most optimistic outcomes to potential worst-case situations, into pro formas ensures a comprehensive financial analysis. This approach equips project teams with the ability to anticipate various futures, effectively preparing them for swift adaptation to changing circumstances. By mapping out these different trajectories, stakeholders can better understand the financial resilience of the project under diverse conditions, enabling more informed decision-making and strategic planning.

Understand the ins and outs of the contract.

Grasping the nuances of different contract types and their implications on a pro forma is essential for accurate financial planning. By choosing contracts wisely and meticulously analyzing general conditions, project stakeholders can manage financial risk more effectively.

For example, under a GMP agreement, the contractor commits to completing the project within a specified maximum price. This approach shifts the risk of cost overruns from the owner to the contractor, incentivizing efficient management and cost control throughout the project.

By drilling down on general conditions and understanding the implications of different contract types, stakeholders can better predict financial outcomes, fostering a transparent and accountable project environment that aligns with the project's financial goals and constraints.

The Role of the Pro Forma in Project Success

In the realm of construction, owners use pro formas to chart the financial path of a project from its inception to completion. For owners, the generation of revenue is intricately tied to the completion of the project, marking a distinct contrast from contractors and subcontractors whose income is linked to the ongoing execution of work. This fundamental difference highlights how crucial precise planning and execution is for owners — for whom the occupancy date and subsequent milestones are not just targets but essential benchmarks that directly impact their financial return.

Owners are invested in the long-term financial performance of the project, anticipating revenue over extended periods -- often spanning decades after the project is completed. This long-term perspective necessitates a thorough and forward-looking approach to financial planning, embodied in the creation and analysis of pro formas. These documents serve as a financial blueprint, allowing owners to forecast revenue, anticipate costs and assess potential risks with a high degree of accuracy.

By laying out a clear financial path, pro formas enable owners to make informed decisions, secure financing and plan for sustainable profitability. The emphasis on early planning and risk assessment is crucial, as it allows owners to align their strategies with the projected financial outcomes, ensuring that the project not only reaches completion but does so in a manner that is financially viable and profitable in the long run.

Was this article helpful?

Thank you for your submission.

91%

9%

You voted that this article was . Was this a mistake? If so, change your vote

Scroll less, learn more about construction.

Subscribe to The Blueprint, Procore’s construction newsletter, to get content from industry experts delivered straight to your inbox.

By clicking this button, you agree to our Privacy Notice and Terms of Service.

Thank you!

You’re signed up to receive The Blueprint newsletter from Procore. You can unsubscribe at any time.

Categories:

Written by

Nina Pryor

Senior Solutions Engineer | Procore

Nina Pryor is a Senior Solutions Engineer at Procore. She previously worked in construction consulting and project management for several developers from Los Angeles to New York, including WeWork, CBRE, and Turton Bond. Before diving into construction, Nina worked as a financial analyst for JPMorgan Chase. She lives in Los Angeles.

View profile

Taylor Riso

Contributing Writer

95 articles

Taylor Riso is a marketing professional with more than 10 years of experience in the construction industry. Skilled in content development and marketing strategies, she leverages her diverse experience to help professionals in the built environment. She currently resides in Portland, Oregon.

View profileExplore more helpful resources

Job Profitability Reports: Turning Data into Strategic Decisions

In the construction industry, understanding the financial position of each job can be key to a company’s success. Job profitability reports provide a clear view of a project’s financial performance,...

How to Manage Cash Flow Throughout the Construction Lifecycle

Navigating the financial ebbs and flows of construction projects demands a deep understanding of how to manage cash flow. Cash flow management in construction is the practice of overseeing and...

Construction Cash Flow Projection: A Deep Dive into Financial Forecasting

Cash flow projection is instrumental in evaluating a project’s financial health and maintaining firm operational stability: These projections serve as a strategic roadmap for financial decision-making, helping to identify potential...

Guide to S-Curve Modeling in Construction

Navigating the intricacies of construction projects requires meticulous planning, resource allocation and monitoring to ensure success. In this fast-paced and dynamic industry where time and resources are often at a...

Free Tools

Calculators

Use our calculators to estimate the cost of construction materials for your next project.

Templates

Find a template to help you with your construction project tasks.

Material Price Tracker

Get the latest U.S. retail prices and view historical trends for common building materials.

Glossary

Explore key terms and phrases used in the industry.