— 11 min read

Construction Cash Flow Forecast: A Step-by-Step Guide

Last Updated Sep 23, 2025

Nicholas Dunbar

Content Manager

65 articles

Nick Dunbar oversees the creation and management of UK and Ireland educational content at Procore. Previously, he worked as a sustainability writer at the Building Research Establishment and served as a sustainability consultant within the built environment sector. Nick holds degrees in industrial sustainability and environmental sciences and lives in Camden, London.

Last Updated Sep 23, 2025

In construction, sound financial management revolves around the cash flow strategy: knowing when money will come in, how much will go out, and whether the gap between the two is manageable. For companies juggling multiple projects and rising costs, cash flow issues can shift from a mild concern to a major risk in weeks. That’s where a construction cash flow forecast comes in. Forecasting helps teams anticipate financial fluctuations, enabling them to allocate resources with confidence and reduce uncertainty.

This guide explains what a construction cash flow forecast is, how to build one, and the tools and techniques that support more informed, future-focused decisions.

Table of contents

What is a construction cash flow forecast?

A construction cash flow forecast is an estimate of a project’s expected income and expenditure over a defined period, based on when money is due to come in – typically from client payments – and when it is expected to go out, covering costs like materials, labour, equipment, and subcontractors.

Unlike general cash flow tracking, which looks at historical data, a forecast provides a real-time projection of future financial movement. This makes it a vital planning tool, helping contractors identify potential shortfalls, assess project viability, and make timely financial decisions.

For construction firms operating in a high-risk, high-cost environment, the cash flow forecast is essential for smoother delivery, better risk management, and long-term financial health.

Key Benefits of Construction Cash Flow Forecasting

While creating a construction cash flow forecast is good financial practice, it can also offer companies a strategic advantage. Forecasting equips firms to shift from reactive problem-solving to proactive decision-making across all stages of a project. Here’s an overview of its key benefits:

- Improved Financial Management

Accurate forecasts help maintain liquidity by identifying when cash will be available – and when it won’t. This helps firms meet financial obligations on time, avoid shortfalls, and reduce reliance on emergency financing.

- Informed Decision-Making

With a clear picture of projected inflows and outflows, companies can make more confident choices about bidding on new projects, allocating resources, or delaying non-essential spending.

- Risk Mitigation

Forecasting highlights potential cash flow gaps or budget overruns before they occur. This enables teams to take corrective action, such as adjusting procurement schedules, re-sequencing work, or renegotiating payment terms.

- Stronger Stakeholder Relationships

Timely payments build trust across the supply chain. Reliable forecasting also helps maintain credibility with lenders, investors, and clients by demonstrating financial discipline.

- Operational Efficiency and Profitability

Forecasting gives project managers more control over sequencing, procurement, and resourcing, helping to guarantee that key milestones aren’t missed due to funding issues. It also supports smarter cost management, reduced waste, and maximises profit margins, particularly on long or multi-phase projects.

- Compliance and Reporting Readiness

For larger contracts or public-sector work, detailed forecasting supports financial reporting obligations and strengthens transparency in audits or board reviews.

- Competitive Edge in Tendering

Firms that forecast well are better positioned to offer realistic pricing and delivery timelines, making them more competitive during the tendering process.

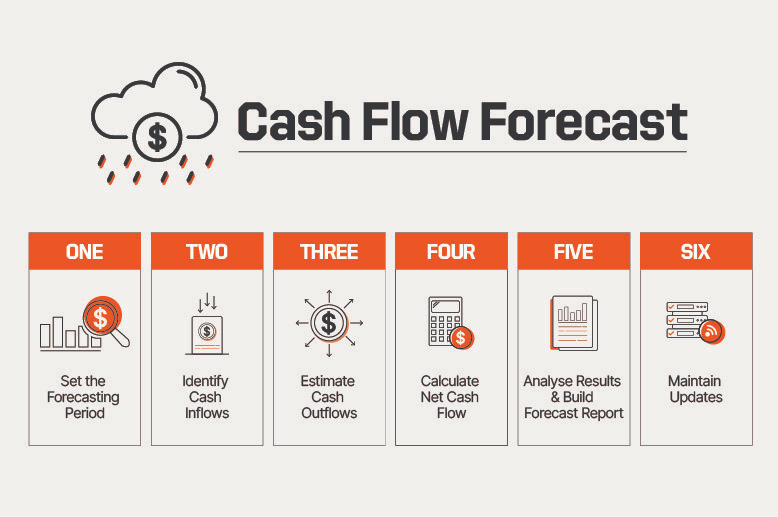

How to Create a Construction Cash Flow Forecast

Creating a construction cash flow forecast requires reliable data and a series of specific tasks. These are the key steps to follow when building an effective forecast for a company or project:

Set the Forecasting Period

Define the time frame for the forecast. This could span the full project duration or be broken down monthly, fortnightly, or even weekly, depending on the project's complexity and financial risk.

Identify Cash Inflows

Estimate expected sources of income over the period. These may include:

- Progress payments from clients

- Advance payments or deposits

- Loans or lines of credit

- Government grants or subsidiesEstimate Cash Outflows

List all anticipated project costs, such as:

- Materials and equipment

- Labour and subcontractor payments

- Plant hire and transport

- Overheads (utilities, insurance, admin)

- Taxes, finance charges, and loan repaymentsCalculate Net Cash Flow

Subtract total outflows from total inflows for each period. This will reveal whether the company expects a surplus or shortfall at any given time and if corrective action may be needed.

Analyse the Results and Build a Forecast Report

Summarise the results in a clear, structured format that highlights key risk areas and time-based trends. Forecast reports should be shared with relevant stakeholders and reviewed alongside project progress.

Maintain Updates

Forecasts are only as good as the data they contain. Update the forecast regularly with real-time figures from site activity, revised payment dates, or scope changes to make sure it remains reliable for ongoing decision-making.

Common Cash Flow Challenges

Forecasting is rarely black and white in the construction sector, because external factors like contract terms and day-to-day project dynamics often introduce variables that can be difficult to predict. These are some of the most common issues that disrupt cash flow accuracy:

- Delayed Payments from Clients

Long payment cycles remain a major source of strain for construction firms. Even when valuations are submitted on time, delays in approval or processing can interrupt projected inflows and force firms to rely on reserves or credit.

- High Upfront Costs and Retention Payments

Initial procurement, mobilisation, and early-stage labour typically require significant outlay. At the same time, retention clauses withhold a percentage of payments until completion, further reducing available funds during the build.

- Unpredictable Expenses and Cost Overruns

Late-stage design changes, fluctuating material prices, or unexpected site conditions can all inflate costs without warning. Without immediate adjustments to the forecast, these changes can quickly erode liquidity.

- Complex Contractual Terms and Inefficient Billing

Inconsistent or unclear payment terms, particularly if they’re across multiple contracts, can cause confusion and delay. Manual billing processes or administrative delays also contribute to missed invoicing opportunities and inaccurate cash flow data.

- Seasonal Variability

Weather delays, holiday shutdowns, and slower client decision-making at certain times of year can also impact cash flow patterns. These seasonal considerations can be particularly pronounced in civil engineering, infrastructure, and outdoor works.

Strategies for Improving Cash Flow Forecasting

Forecast accuracy depends on the ability to adapt to changing conditions. The following strategies can help construction companies improve forecast reliability:

- Negotiate Better Payment Terms

Agreeing to shorter payment cycles, milestone-based billing, or advance payments can ease pressure on working capital. Early negotiation with clients and subcontractors also helps teams to align payment structures with actual cost timing.

- Streamline Billing and Invoicing

Well-organised invoicing systems and automation tools can reduce delays and guarantee that payment applications are submitted promptly and in the correct format.

- Maintain Solid Cash Reserves

Contingency planning is part of good forecasting. Setting aside reserves for unplanned costs or payment delays helps avoid project disruption and reduces the need for last-minute financing.

- Strengthen Payment Collection Practices

Following up on overdue invoices, offering early payment incentives, and formalising payment expectations in contracts can improve collection rates and keep inflows on track.

- Optimise Project Management

Delays, rework, or poor sequencing can lead to cost escalation and inaccurate cash flow projections. Better planning and cost control help align actual expenditure with forecasted outflows.

- Leverage Technology and Real-Time Data

Using construction management platforms or financial dashboards helps teams track progress against the budget, spot emerging issues early, and update forecasts accordingly.

- Diversify Revenue Streams

Expanding into maintenance, consultancy, or minor works contracts can create steadier income across varying project types, helping offset periods of low cash flow.

- Explore Alternative Financing Options

Invoice financing, supply chain finance, or short-term credit facilities can help bridge cash flow gaps, particularly during periods of growth or when taking on multiple contracts.

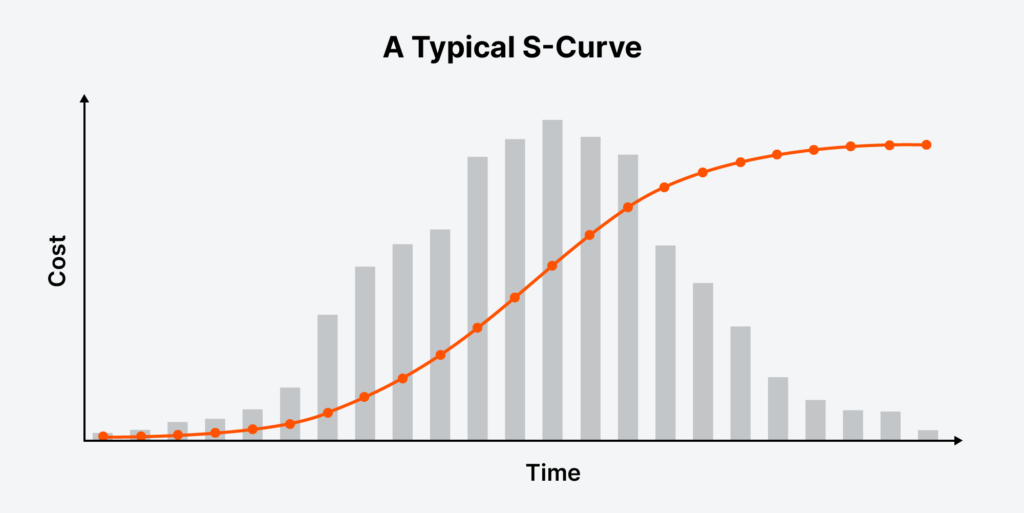

Visualising Cash Flow with the S-Curve

Rather than just viewing numbers, visual tools like the S-curve offer a clearer idea of how a project’s cash flow behaves over time. The S-curve forecasts expenditure, as well as the rhythm of financial movement across a project’s lifecycle, mapping cumulative costs or income against time. It typically reflects three key phases:

- Slow start: Initial mobilisation and procurement

- Rapid acceleration: Peak construction activity and spending

- Tapering off: Finishing works, snagging, and final payments

By comparing planned versus actual curves, it is easier to identify variances, such as unexpected early spending or delayed income. This makes the S-curve particularly useful for spotting signs of cash flow stress or misalignment. S-curves make forecasts easier to interpret, which enables teams to communicate better with stakeholders.

Technology and Tools for Forecasting

While many construction companies, particularly smaller firms, still rely on spreadsheets, a growing number are turning to digital tools as a substitute or supplement. Spreadsheets may offer flexibility and a low cost, but they require manual updates and are prone to error, especially when managing multiple stakeholders or long project timelines. Digital tools and emerging tech can offer companies more real-time insights. Key technologies with an increasing userbase and influence include:

Construction Management Platforms

Integrated project management tools often include forecasting features that track budgets, commitments, and payments across multiple projects. These can update forecasts dynamically as site conditions or client payment dates change.

ERP Systems

Enterprise Resource Planning (ERP) systems provide a centralised view of financial data across the entire business. For larger UK contractors managing several workstreams or regions, ERPs can improve consistency and reduce reporting delays.

AI and Machine Learning

Artificial intelligence is beginning to shape forecasting tools by identifying patterns in historical data and flagging potential cash flow issues before they arise. While adoption is still emerging, some platforms now offer predictive alerts based on project behaviour, contract history, or client payment trends.

Digital tools can help support compliance for firms operating under the Construction Act or working on public sector frameworks by helping with document payment timelines, tracking retentions, and standardising invoicing procedures across projects.

Avoiding Common Forecasting Pitfalls

Below are common issues that affect construction businesses, with tips on how to reduce their impact:

- Poorly Structured Contracts

Ambiguous or inconsistent payment terms can lead to unpredictable inflows. Aligning contracts with standard industry frameworks such as JCT or NEC and clearly defining milestone payments and timelines helps maintain better forecast accuracy.

- Inaccurate Work-in-Progress (WIP) Tracking

Over- or underestimating the value of completed work distorts income projections. Regular site-based reporting and close coordination with quantity surveyors improve visibility and reduce variance between projected and actual cash flow.

- Delayed Invoicing and Weak Collection Practices

Failing to invoice on time or follow up on overdue payments breaks the forecasting cycle. Automated reminders and internal controls can lead to more disciplined invoicing and keep cash inflows aligned with expectations.

- Ignoring Retainage (Retention)

Retentions withheld by clients can significantly delay final income. Forecasts should account for both the timing and likelihood of retention release, especially when working under public-sector contracts, where retention practices may differ.

- Underestimating Contingency Needs

Unplanned delays, design changes, or supplier issues can create sudden cash demands. Allocating a realistic contingency and reviewing it regularly protects working capital from being stretched too thin.

- Mixing Business and Personal Finances

In smaller firms, a failure to separate personal and project-related cash flow can distort reality and lead to forecasting errors. Using dedicated accounts and bookkeeping software improves transparency and compliance.

The Different Cash Flow Categories

While project forecasts focus primarily on operational cash flow, construction companies also need visibility over how money moves through the organisation. Understanding the three main categories of cash flow helps build a more complete picture of financial health.

Cash Flow from Operations (CFO)

This refers to income and expenditure from core business activities, such as client payments, staff wages, subcontractor fees, and material costs. Operational cash flow is the most immediate concern for construction firms and the focus of most project-level forecasting.

Cash Flow from Investing Activities (CFI)

This includes purchases or sales of long-term assets, such as machinery, land, or new technology. While these don’t affect day-to-day project delivery, they do impact overall liquidity, particularly when they occur close to other large outflows.

Cash Flow from Financing Activities (CFF)

This covers inflows from loans, investor capital, or credit facilities, and outflows like loan repayments or dividend payments. For companies scaling up or managing multiple contracts, financing activities can be a key source of working capital.

Separating these categories helps construction companies analyse where cash is being generated or lost to help them make better decisions concerning reinvestment, borrowing, and growth. It also facilitates reporting, especially for firms required to produce full financial statements under UK accounting standards.

A well-structured construction cash flow forecast is a planning tool that supports smarter decisions and long-term business growth. When backed by reliable data, clear processes, and the right technology, forecasting gives construction teams the visibility they need to handle uncertainty with confidence. In an industry where timing is everything, companies who forecast well are better placed to protect their profit margins and seize new opportunities as they arise.

Categories:

Written by

Nicholas Dunbar

Content Manager | Procore

65 articles

Nick Dunbar oversees the creation and management of UK and Ireland educational content at Procore. Previously, he worked as a sustainability writer at the Building Research Establishment and served as a sustainability consultant within the built environment sector. Nick holds degrees in industrial sustainability and environmental sciences and lives in Camden, London.

View profileExplore more helpful resources

Construction Quality Control: Avoiding Costly Mistakes

Every construction project begins with a client’s vision, which the design team translates into drawings and specifications. Contractors, subcontractors, and suppliers then provide the materials, equipment, and labour to bring...

Invitation to Tender (ITT) in Construction

An invitation to tender (ITT) is an official document a client issues to encourage contractors to submit tenders for a construction project. The ITT provides all tenderers with information about...

Liquidated & Ascertained Damages (LADs) in UK Construction

Staying on programme is one of construction’s greatest challenges. Contractors must juggle multiple clients’ deadlines, labour, and plant – and when delays occur, the consequences extend well beyond inconvenience. Contracts...

Constructability: Reviewing Designs to Mitigate Construction Risks

From the Guggenheim Museum in Bilbao to 8 Spruce Street in Manhattan, Frank Gehry’s buildings are known for being distinctive and expensive – yet delivered on time and within budget. ...