— 9 min read

UK Construction Accounting: An Introduction

Last Updated Oct 23, 2025

Brittney Abell

Manager, Strategic Product Consultants

14 articles

Brittney Abell joined Procore after 6 years as an accounting manager for a commercial general contractor, overseeing accounts payable and receivable. Before that, she worked as a contract administrator for an architecture & design firm for 6 years. She has worked on a variety of building projects, including travel stops, restaurants, hotels, and retail warehouses raging from $2M to $20M. She lives in Louisville, Kentucky

Daniel Gray

Contributing Writer

33 articles

Daniel is an educator and writer with a speciality in construction. He has been writing construction content for Procore since 2022, and previously served as a Procore Content Manager before continuing to pursue an education career as an Assistant Headmaster for Valor Education in Austin. Daniel's experience writing for construction — as well as several clients under an agency — has broadened his knowledge and expertise across multiple subjects.

Nicholas Dunbar

Content Manager

65 articles

Nick Dunbar oversees the creation and management of UK and Ireland educational content at Procore. Previously, he worked as a sustainability writer at the Building Research Establishment and served as a sustainability consultant within the built environment sector. Nick holds degrees in industrial sustainability and environmental sciences and lives in Camden, London.

Zoe Mullan

27 articles

Zoe Mullan is an experienced content writer and editor with a background in marketing and communications in the e-learning sector. Zoe holds an MA in English Literature and History from the University of Glasgow and a PGDip in Journalism from the University of Strathclyde and lives in Northern Ireland.

Last Updated Oct 23, 2025

Construction companies face difficult financial choices, such as bidding on one project over another, selecting financing for materials or plant, or setting a project's profit margin. Construction is a notoriously volatile industry with a high failure rate, slow payment times, and inconsistent cash flow.

Accurately tracking costs, revenues, and other financial data creates a foundation for companies to grow and stay cash flow positive. Given the unique financial challenges that construction businesses face, well-developed accounting processes are essential for executives who need to allocate financial resources efficiently.

Table of contents

Why Construction Accounting is Different

Construction is project-based, so every job presents new challenges. Unlike manufacturers, contractors constantly move between sites, rely on different specialist suppliers, and face payment structures that withhold retention until completion. The result is irregular cash flow and a heavier administrative burden.

UK construction contracts, particularly those following JCT or NEC forms, commonly include a 5% retention, with half released at practical completion and the remainder after defects are remedied. Coupled with slow payment cycles, this can squeeze cash reserves. Consequently, accurate accounting and proactive financial analysis are vital.

Job Costing

Job costing allocates every pound spent or earned to a specific project code. A typical cycle follows three stages:

- During the project, record costs with detailed cost codes

- After completion, archive the ledger

- Before bidding, analyse past ledgers to refine future estimates

For example, a London refurbishment contractor might code "02-Groundwork," "07-Brickwork," and "14-M&E," then benchmark against BCIS indices to spot inflation trends and sharpen tenders.

Work-in-Progress (WIP)

Moving beyond basic job costing, WIP schedules reconcile certified work against job costs to date, flagging over- or under-billing early. WIP should be aligned with retention balances so quantity surveyors and finance teams can correct issues before margins erode.

Accounting Methods

UK contractors generally choose among four methods, which they must confirm against FRS 102 or IFRS 15:

Cash

Cash accounting recognises income and expenses only when money changes hands. This method offers simplicity but provides little foresight and usually suits only micro businesses.

Accrual

Accrual accounting records income when invoices are issued and costs when bills arrive. Because retention isn't recognised until it becomes due, this method gives a forward-looking view but may trigger Corporation Tax on revenue not yet collected.

Percentage of Completion

This method recognises revenue, costs, and profit in proportion to project completion. If a contractor has spent £15,000 on a £100,000 contract, the method books 15% of income and profit. HMRC sets no strict turnover test, but large UK contractors typically use this method.

Completed Contract

This approach defers income and costs until a contract ends, reducing estimation risk on short jobs but causing large swings in reported profit for long-term works.

Accounting for Construction Contracts

Five primary contract types shape how contractors record accounting entries:

- Lump sum

- Time and materials (T&M)

- Unit price

- Guaranteed maximum price (GMP)

- Cost-plus

Understanding each form, especially standard JCT or NEC clauses, helps align cost tracking with payment schedules.

Managing Retainage (Retention)

Retention secures project completion but delays cash flow. Contractors track these sums in ledger accounts labelled "retention receivable" and "retention payable" until release. From 2025, certain projects must hold retention in project trust accounts under the Building Safety Act.

Construction Industry Scheme (CIS)

Under the CIS, contractors must deduct tax at source from subcontractors and remit it to HMRC. Correct CIS processing affects weekly payroll, cash forecasts, and year-end returns. More information is available on HMRC.

VAT Domestic Reverse Charge

Since 1 March 2021, most B2B construction services fall under the reverse charge. Subcontractor invoices state "VAT reverse charge: customer to account for output tax", and main contractors declare both output and input VAT on their return. Example wording on an invoice: "VAT amount: £0.00 – Reverse charge applies. Customer to account for output VAT at 20%."

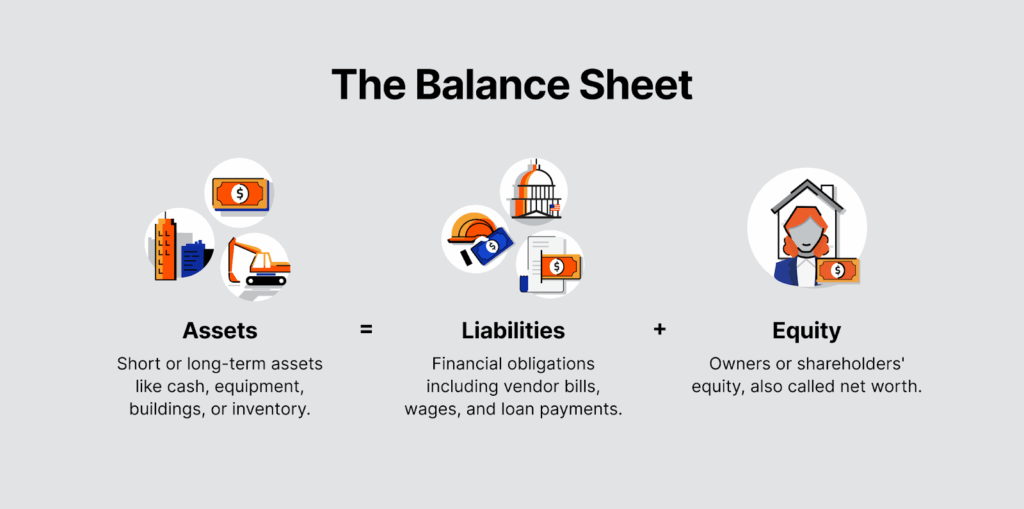

Balance Sheets

A balance sheet provides an overview of a company's finances, including assets, liabilities, and equity. Producing a monthly balance sheet proves crucial for tracking a construction business's financial health, while a balance sheet produced at the end of the fiscal year offers a compelling look at year-over-year growth.

The three sections of the balance sheet – assets, liabilities, and equity – each provide a different perspective on the company's finances. However, all three sections relate to one another, as total assets equal the sum of liabilities and equity.

Assets

Assets represent a company's financial resources – in other words, anything that is cash or could likely convert to cash.

Examples of assets include cash, accounts receivable (AR), inventory, and due from construction loans.

Liabilities

Liabilities represent a company's financial obligations, which include both short-term and long-term debt.

Examples of liabilities include accounts payable (AP), capital lease payable, accrued payables, and notes payable.

Equity

Equity, also referred to as net worth, comprises the assets remaining after liabilities are settled. This equity may belong to the owner or shareholders, depending on the business structure.

For example, corporations break down their equity into investments, retained earnings, and net income. On the other hand, sole traders and partnerships simply list the capital belonging to the owner – or to multiple owners.

Income Statements

The income statement (or profit and loss statement) provides a breakdown of the revenues, costs, and profit during a specific period of time – often monthly, quarterly, and annually.

Revenues

Construction businesses record their revenues based on the accounting method they use. For example, a company using the accrual method notes revenues based on billed payments even if it hasn't actually received payment.

Costs

Materials, labour, equipment, and subcontracts appear as costs on the income statement. These costs include both direct costs (which can be easily assigned to a specific project aspect) and indirect costs (which a project requires but cannot be easily tied to a particular component).

Equipment used for a single job is simply listed under construction costs. However, equipment used across multiple jobs has its own category that tracks all related expenses – like lease payments, depreciation, fuel costs, maintenance, and repairs – to accurately spread those costs across projects.

Overhead costs, which are essential for operation but don't tie to a specific project, appear in a separate area of the income sheet. These costs include items like insurance, rent, marketing, and benefits. Properly managing and allocating overhead expenses proves crucial for contractors, as it directly impacts the company's profitability and long-term financial stability.

Profit

On an income statement, profit is calculated in several ways:

- Gross profit equals revenues minus costs

- Net profit equals gross profit minus overhead

- Profit before taxes equals net profit

- Profit after taxes equals net profit minus income taxes

Importantly, the income sheet's view of profit must match the change in equity reflected on the balance sheet.

Key Accounting Ratios

Accounting ratios offer calculations that help construction businesses gain an overview of their financial health. While dozens of ratios exist, the most common include the following:

Current Ratio

The current ratio evaluates how readily a company can use current assets to cover current liabilities. To calculate the current ratio, simply divide current assets by current liabilities.

Companies aim to have a current ratio above 1, which indicates they have enough revenue to pay their debts. Companies with current ratios below 1 will likely need debt or equity financing to pay their liabilities.

Quick Ratio

The quick ratio measures whether a company can pay current liabilities with cash or assets that can be quickly converted to cash. To calculate the quick ratio, simply add cash and accounts receivable and divide that sum by current liabilities.

A business with a quick ratio above 1 qualifies as liquid, meaning it has enough cash resources to pay its current liabilities. Conversely, a business with a quick ratio below 1 lacks sufficient cash resources, so it will need to secure an influx of cash through financing or by selling other long-term assets.

Notably, a business doesn't want a quick ratio that's too high, which indicates an excess of cash that could be invested more prudently elsewhere.

Debt-to-Equity Ratio

The debt-to-equity ratio evaluates the risk facing a business's creditors and owners. To calculate the debt-to-equity ratio, divide total liabilities by net worth.

Most companies target a debt-to-equity ratio between 1 and 2. Companies with a debt-to-equity ratio higher than 2 may struggle to pay off their debts. On the other hand, a company with a debt-to-equity ratio of less than 1 may not be using enough debt financing to take on new projects and grow.

Working Capital Turnover

Working capital turnover measures how much revenue each pound of working capital produces. To calculate working capital turnover, first calculate working capital, which equals current assets minus current liabilities. Then, determine the turnover by dividing revenues by working capital. Main contractors need to subtract subcontractor payments from revenues to calculate working capital turnover, as this money simply passes through the general contractor from the owner.

In general, a higher working capital turnover ratio is better. A higher number indicates that each pound of working capital spent generates more revenue in sales. Across the construction industry, average working capital turnover ranges from 5 to 15, depending on specialisation.

Notably, a very high working capital turnover ratio could indicate that the business lacks sufficient capitalisation, meaning it won't have enough capital to support its own growth from high sales volume.

Choosing UK Construction Accounting Software

Choosing the right accounting platform can make or break a contractor's ability to stay compliant and profitable. Before diving into feature lists, contractors should pause to define exactly what their finance and site teams need – from CIS calculations and reverse-charge VAT to real-time WIP dashboards. The brief guide below helps evaluate software options through a UK construction lens to support confident investment decisions.

Select software that:

- Handles CIS and reverse-charge VAT natively

- Offers mobile time-sheet capture

- Provides WIP and retention dashboards

- Connects to project-management tools via API

- Meets Making Tax Digital requirements for VAT and Income Tax (from April 2026)

Prepare a matrix of functional needs versus vendor features before creating a shortlist.

Tax Incentives and Reliefs

Beyond day-to-day bookkeeping, smart contractors use the tax code to strengthen cash flow and fund growth. The UK offers several generous incentives – if contractors know where to look and how to claim them. Key reliefs for construction firms include:

- Capital allowances for qualifying plant and land-remediation costs

- R&D tax relief for digital construction and off site innovation

- Corporation Tax stands at 25% on profits above £250,000

Cost Control Through Construction Accounting

Proactive contractors use detailed job costing, WIP analysis, and compliant software to forecast cash flow, tighten margins, and grow sustainably – even while navigating CIS, retention, and VAT requirements. By implementing the practices outlined in this guide, construction businesses can transform accounting from a compliance burden into a strategic tool that drives profitability and supports long-term success.

Categories:

Written by

Brittney Abell

Manager, Strategic Product Consultants | Procore

14 articles

Brittney Abell joined Procore after 6 years as an accounting manager for a commercial general contractor, overseeing accounts payable and receivable. Before that, she worked as a contract administrator for an architecture & design firm for 6 years. She has worked on a variety of building projects, including travel stops, restaurants, hotels, and retail warehouses raging from $2M to $20M. She lives in Louisville, Kentucky

View profile

Daniel Gray

Contributing Writer

33 articles

Daniel is an educator and writer with a speciality in construction. He has been writing construction content for Procore since 2022, and previously served as a Procore Content Manager before continuing to pursue an education career as an Assistant Headmaster for Valor Education in Austin. Daniel's experience writing for construction — as well as several clients under an agency — has broadened his knowledge and expertise across multiple subjects.

View profileReviewed by

Nicholas Dunbar

Content Manager | Procore

65 articles

Nick Dunbar oversees the creation and management of UK and Ireland educational content at Procore. Previously, he worked as a sustainability writer at the Building Research Establishment and served as a sustainability consultant within the built environment sector. Nick holds degrees in industrial sustainability and environmental sciences and lives in Camden, London.

View profile

Zoe Mullan

27 articles

Zoe Mullan is an experienced content writer and editor with a background in marketing and communications in the e-learning sector. Zoe holds an MA in English Literature and History from the University of Glasgow and a PGDip in Journalism from the University of Strathclyde and lives in Northern Ireland.

View profileExplore more helpful resources

Construction Quality Control: Avoiding Costly Mistakes

Every construction project begins with a client’s vision, which the design team translates into drawings and specifications. Contractors, subcontractors, and suppliers then provide the materials, equipment, and labour to bring...

Invitation to Tender (ITT) in Construction

An invitation to tender (ITT) is an official document a client issues to encourage contractors to submit tenders for a construction project. The ITT provides all tenderers with information about...

Liquidated & Ascertained Damages (LADs) in UK Construction

Staying on programme is one of construction’s greatest challenges. Contractors must juggle multiple clients’ deadlines, labour, and plant – and when delays occur, the consequences extend well beyond inconvenience. Contracts...

Constructability: Reviewing Designs to Mitigate Construction Risks

From the Guggenheim Museum in Bilbao to 8 Spruce Street in Manhattan, Frank Gehry’s buildings are known for being distinctive and expensive – yet delivered on time and within budget. ...