Article

Building the Future: Innovation and Tech in ASEAN Construction

Discover key insights from the 2023 ASEAN Constructors Federation Conference. Uncover the trends and technologies shaping how we build ASEAN’s future.

Want to learn more? We’re here to help

Hosted by the Philippine Constructors’ Association (PCA), the ASEAN Constructors Federation (ACF) Conference 2023 and 53rd ACF Council Meeting was held at Clark Marriott in the Philippines on 31 March 2023. Attended by over 80 delegates and ACF members across Cambodia, Indonesia, Malaysia, Myanmar, Thailand, Singapore, and the Philippines; this year’s theme was “ASEAN Resilient Growth”.

Chapter 1

Opening Address: A Stronger, More Resilient ASEAN

In his opening address, Mr Oliver H.C. Wee, Chairman of ACF, recognised the significant changes and challenges the industry faces as a result of the pandemic. From supply chain disruptions and financial difficulties to climate change and geo-political uncertainties, each challenge has directly or indirectly led to unforeseen risks, delays, and overspending. With that said, Mr Wee maintained an optimistic outlook for the future. ASEAN’s rapid urbanisation and population growth are spurring infrastructure demands. With this comes opportunities for companies to expand, innovate, and thrive.

According to Mr Wee, there are two specific areas that construction firms need to prioritise. First, as the industry focuses on clear and present challenges; one eye must be fixed on the future. This involves investing in research and development, as well as exploring new technologies and practices. Mr Wee believed that these would serve to improve efficiency, sustainability, and safety across the industry.

Second, Mr Wee implored construction firms to embrace innovation and creativity. Beyond the projects themselves, it is about the industry approaching and solving problems in brand new ways. This requires fostering an environment that encourages innovation while constantly iterating to achieve success, resilience, and growth.

Finally, Mr Wee shared his thoughts on the fellowship in attendance at the ACF Conference and the 53rd ACF Council Meeting. He emphasised the importance of having such a community in place, which he believed to be the key to powering through the headwinds, making a difference, and creating a more resilient ASEAN.

“The fellowship gathered here today is a testament to the power of ACF. Whether it is through our work, our passions, or our relationships, we all can make a difference and make positive impacts.” — Oliver H.C. Wee, Chairman, ASEAN Constructors Federation.

Chapter 2

A Change of Leadership

Towards the end of the 53rd ACF Council Meeting, Mr Wee passed the baton of his chairmanship to Mr Augusto Manalo, Past President of PCA, who will take on the role of Chairman of ACF Council Term spanning from 2023 to 2025.

Mr Manalo will lead the new Council Term along with representatives from seven associations from the region, including Cambodia Constructors Association, Indonesian Contractors Association, Master Builders Association Malaysia, Myanmar Construction Entrepreneurs Federation, Philippine Constructors Association, Singapore Contractors Association Ltd, and Thai Contractors Association.

Chapter 3

ASEAN Construction Industry at a Glance

Headwinds on the Horizon

The economic outlook in the ASEAN region is multifaceted. On one hand, ASEAN is one of the fastest-growing construction markets in the world and remains desirable for foreign direct investments. Commercial and state investments are also expected to remain steady throughout 2023. However, economic growth will likely fall marginally from 5.5% in 2022 to 4.7% in 2023, in part due to worsening global economic conditions and tightening monetary policies.

These larger economic conditions have led to unfavourable conditions for the construction industry and its growth resiliency. These include the global inflationary climate, increasing interest rates, fluctuating material costs, and disruptions across the global supply chain.

Furthermore, project reworks continue to be the primary cause of delays, safety risks, and over-budgeting. It is estimated that the annual cost of rework will remain at a high of about US$500 billion for 2018.

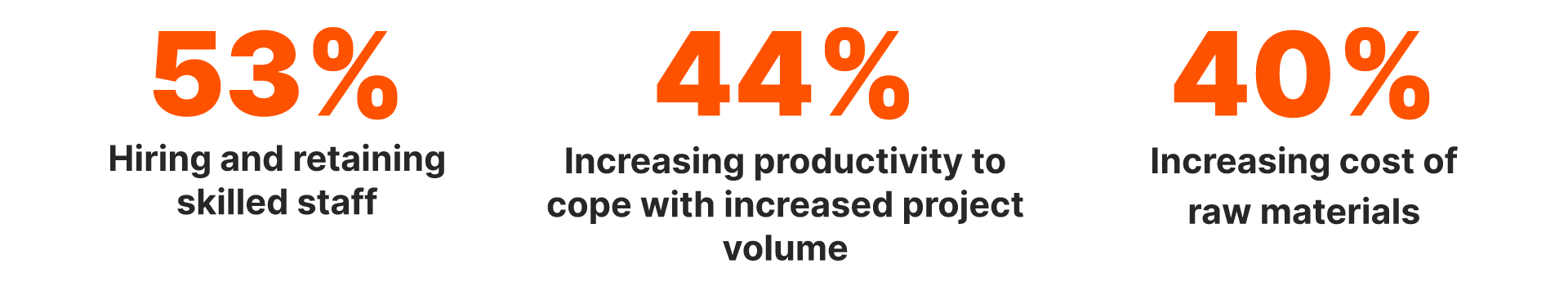

Attendees at the ACF Conference also shared the challenges they faced on the ground. According to a survey conducted among the attendees, hiring and retaining skilled staff (53%), increasing productivity to cope with increased project volume (44%), and the increasing cost of raw materials (40%) were the top challenges for the ASEAN construction industry.

While technology can alleviate some of these challenges, the construction industry still ranks second from the bottom when it comes to technology adoption. About 96% of engineering and construction data goes unused, and 13% of working hours are spent looking for project data and information.

Some markets are already feeling the pressure. According to the Indonesian Contractors Association, while growth in the construction industry has recovered from its five-year low in 2020, its growth rate of 2.01% in 2022 was still less than half of 2019’s numbers. The Thai Contractors Association, too, reported a slowing down of the construction sector’s contributions to Thailand’s GDP, specifically in public projects.

Growth Opportunities Abound in ASEAN

Yet, a positive outlook is just over the horizon for the region.

According to the Master Builders Association Malaysia, the value of work done in Malaysia’s construction sector grew by 8.8% in 2022, or the highest growth rate over the last five years. The actual value of work also reached US$27.7 billion (MY$121.9 billion) in 2022, the highest since the pandemic hit in 2020.

Similarly, PCA also had good news to share with the Philippines. The total value of construction projects in the Philippines saw year-on-year growth of 19.5% in Q2 2022, then a further 12.2% in Q3 2022. Major contributors to these numbers are the projects happening there, including the US$15.1 billion North-South Railway Project.

These numbers also reflect the global trend. The construction industry is set to grow from US$11 trillion to US$15 trillion between now and 2030.

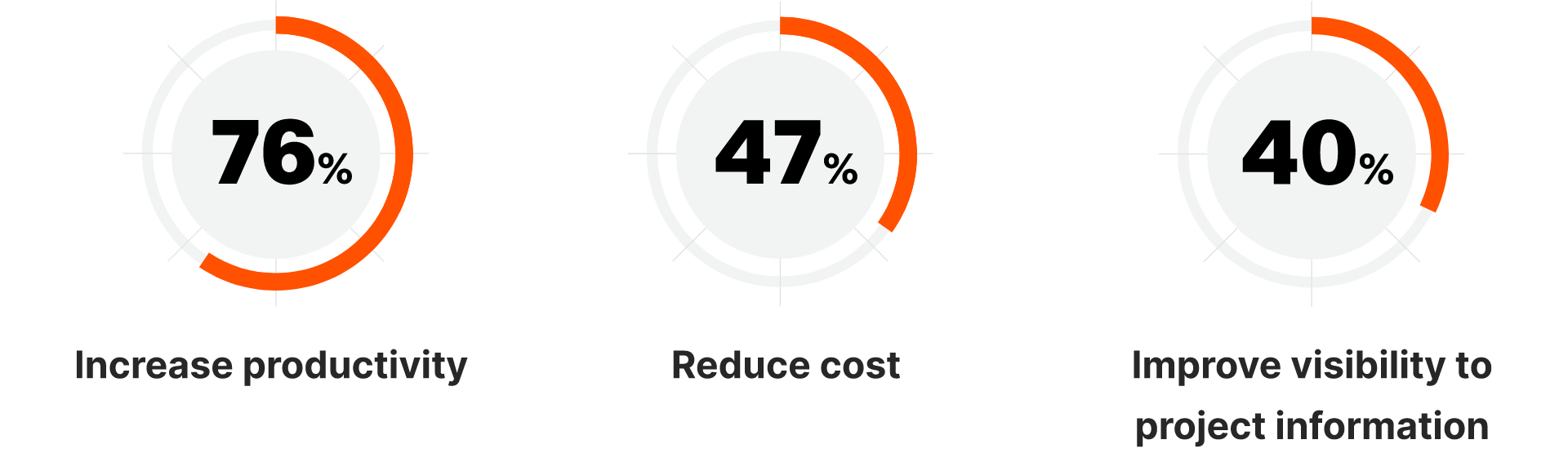

On the technology front, adoption rates among construction businesses are slowly but surely increasing. According to the survey conducted by Procore at the event, 67% of respondents already have plans to increase their spending on construction technologies over the next 12 months. Respondents understand that leveraging data more effectively will increase productivity (76%), reduce cost (47%), and improve the visibility of project information (40%).

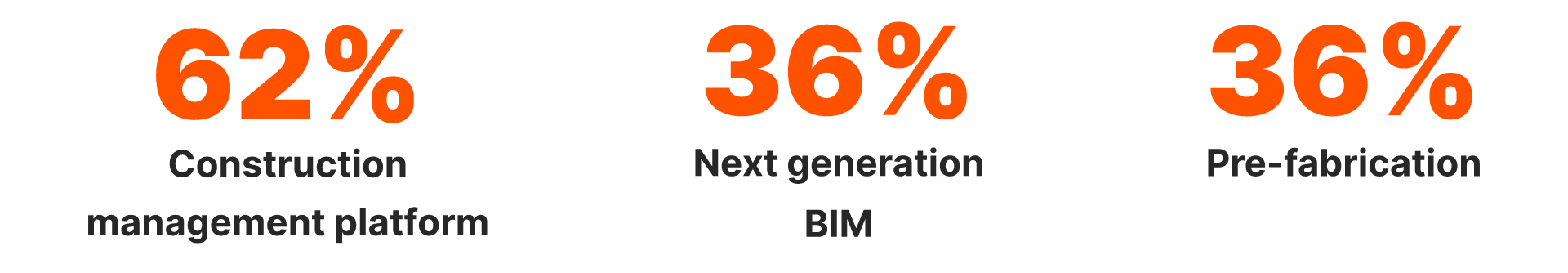

Across the technology available in the construction industry, 62% of respondents see construction management platforms as the biggest driver of change for their business over the next three years.

After two years of lockdowns and work stoppages, the industry’s emphasis on technology is an encouraging turn. With construction projects resuming and demands increasing across the region, technology will be the competitive differentiator for construction businesses that thrive and those that are merely managing to get by.

Chapter 4

Key Presentation Highlights

Tapping Free Trade Agreements to Bolster Growth

Ms Marie Sherlyn D. Aquia, Director III of Department of Trade and Industry (DTI) within the Bureau of International Trade Relations, shared the latest Free Trade Agreements (FTAs) that the Philippines has with various countries, as well as how the local construction industry can benefit from them.

One such agreement is the Regional Comprehensive Economic Partnership (RCEP), which is a trade agreement among 10 ASEAN members and five external partners. The RCEP is designed to standardise rules and regulations, break down trade barriers, improve access to advanced customer procedures, and reduce administrative costs for construction businesses in the Philippines.

Ultimately, it aims to open doors for foreign investments, bolster economic activities and sectoral outputs, and grow the construction, transportation, and manufacturing sectors in the Philippines.

“The Regional Comprehensive Economic Partnership will open opportunities for the construction, transportation, and manufacturing sectors. The benefits will accrue to the construction industry due to an inflow of foreign investments, as well as increases in economic activities and sectoral outputs.” — Marie Sherlyn D. Aquia, Director III, Department of Trade and Industry (DTI), Bureau of International Trade Relations.

Building Resiliency with Technology

Procore also gave a brief introduction of the company and how its business has grown over the years. As a leading global provider of construction management software, Procore aims to drive positive change within the construction industry by connecting all stakeholders with a single source of truth on its platform. As of 2023, Procore’s construction management platform has 16,000 customers, over 3.5 million active users, and over one million active projects across 150 countries.

One of the key data challenges among construction companies was managing the huge volumes of inaccessible, siloed data across disparate systems within the organisation. There is an urgent need for companies to adopt technology that connects all processes and information in a single view.

Procore then presented a roadmap that construction companies can follow to fully utilise construction data. It begins with companies storing data in a single location to make them easily accessible across the organisation, agreeing on the same corporate goals and benchmarks to measure progress and outcome, then using historical data to predict and proactively manage risks.

Burgeoning Opportunities in the Philippines

Ms Aileen Anunciacion R. Zosa, President and CEO of Bases Conversion and Development Authority (BCDA) then took the stage to share several major construction projects currently underway in the country.

The highlight was New Clark City, a new 9,450-hectare planned city located within the Clark Special Economic Zone. The city, described as “a new metropolis where nature, lifestyle, business, education, and industries converge”, consists of several major developments in various stages of completion. These include the Clark International Airport, various government and healthcare facilities, educational institutions, industrial parks, as well as parks and nature reserves.

According to Zosa, New Clark City is being developed in four phases and is targeted for completion by 2065. By then, the city will be home to a projected 1.2 million people and employ over 600,000 workers.

“New Clark City will be the first smart, green, intelligent, sustainable, and disaster resilient metropolis in the Philippines. Its land size is 9,450 hectares and BCDA is offering land rights of 75 years to leases or joint venture agreements. This is a game changer because it spreads the development from Metro Manila to Central Luzon and other parts of the country.” — Aileen Anunciacion R. Zosa, President and CEO, Bases Conversion and Development Authority.

Chapter 5

The Procore ACF Survey: Insights from the Industry

As part of the ACF conference, Procore polled attendees on the challenges and opportunities they see in the construction industry, along with how technology and digital transformation will drive improved efficiencies, productivity, and profitability for construction businesses.

Here are a few key takeaways.

Top challenges faced by the ASEAN construction industry

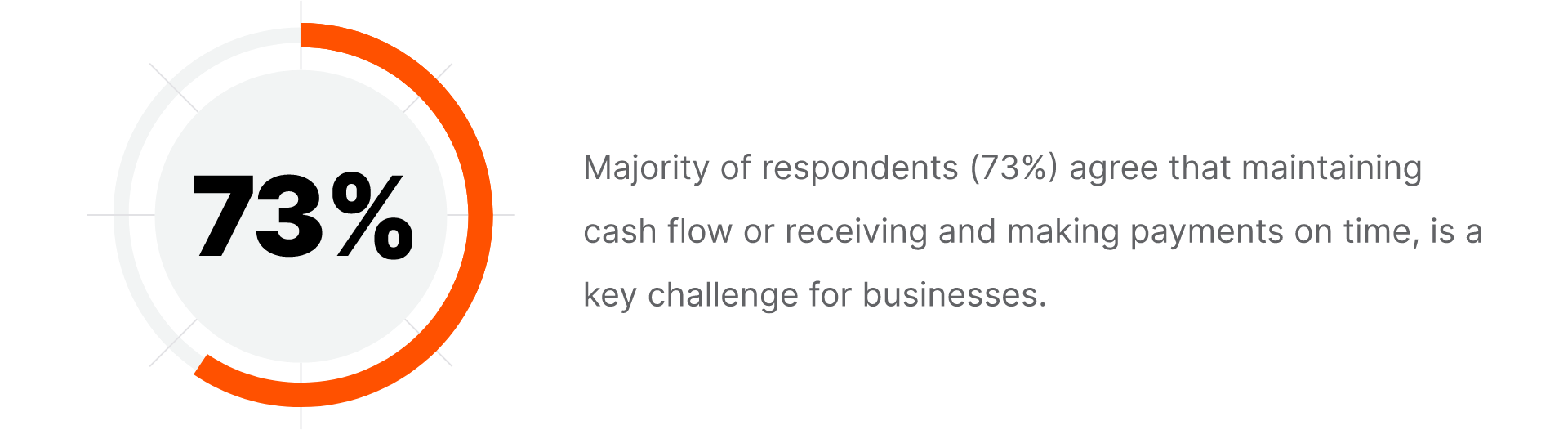

Cash crunch and payment predicaments:

Catching the tech wave:

Are looking to increase their spending on construction technologies as a proportion of the annual budget over the next 12 months

What technologies will drive the most change over the next 3 years?

Construction management platforms (62%) are seen as the biggest driver of change in the construction industry over the next three years, followed by next generation BIM (36%) and pre-fabrication (36%).

Bridging the data strategy gap:

Percentage of respondents who think that leveraging data more effectively would help

Recognising the benefits of capturing, integrating, and standardising data from different parts of their business, 7% of respondents indicated that they have already designed and implemented a data strategy. 76% of respondents plan to do so in the next 12 months.

Barriers in the way of digital transformation:

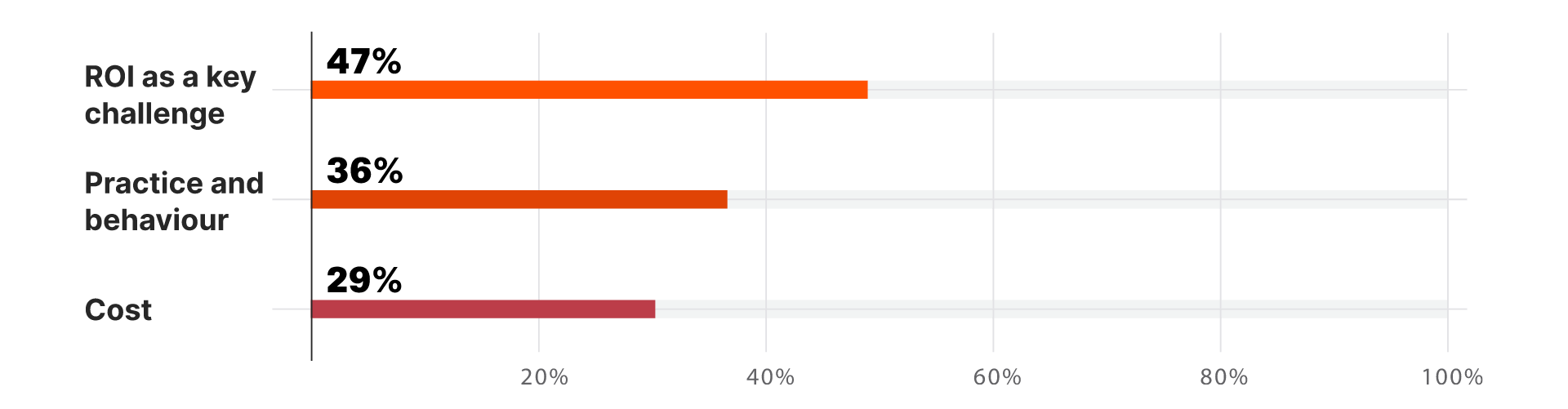

47% of respondents cited justifying ROI as a key challenge when embarking on a digital transformation journey. This is followed by changing established practices and behaviour (36%), and costs (29%).

Chapter 6

Deconstructing the Insights

The business benefits of technology adoption are undeniable, and the majority of construction businesses are looking to increase their spending on construction technologies over the next 12 months.

Edge technologies, such as drones and augmented reality, are generating excitement within the industry. However, beyond the hype, the industry recognises the need to take a step back and solve construction’s fundamental challenge: finding the right people, skills, and equipment, then doing the right job at the right time. At its core, this challenge stems from ineffective communication between stakeholders on and off construction sites.

Integrated construction management platforms, such as the Procore platform, bring all stakeholders together to build better and with more efficiency and to protect margins even in the face of volatility. These platforms continue to be seen as the biggest driver of change in the construction industry now and in the near future.

Construction businesses are also seeing an opportunity to leverage the massive amounts of data generated through technology to make more data-driven decisions across every phase of the construction life cycle. Grounding decisions in data adds predictability to every project. Investing in the right technology is less about future proofing and more about making the ideal future state of businesses a reality today.

However, the path to a golden age of construction may present some obstacles. Justifying the ROI of technology adoption is the top challenge for businesses when embarking on a digital transformation journey. Businesses may prefer for others to adopt technology and generate quantifiable benefits first before encouraging buy-in from management.

But it’s time for construction companies to stop playing “follow the leader”. If they wait too long for proof before they take the plunge, they risk being leapfrogged by fast-moving competitors.

Chapter 7

Next steps: Ushering the Golden Age of Construction

Historically, construction technology was used in a reactive or ‘defensive’ approach to reduce waste and project risk, as well as to ensure every stakeholder is working off the same set of information. These fundamentals protect an industry that is made of low-margin enterprises from going out of business.

However, construction cannot stop at better margins, less rework, and safer jobs — these are just the beginning. The industry needs a mindset shift from ‘defence’ to ‘offence’. Playing defence is to use construction technology to cover our bases. Playing the offence means using data to our advantage, and making decisions that help the business grow.

The future of construction lies in data. Construction intelligence takes the use of data beyond the day-to-day project management practicalities and endorses the use of aggregated current and historical data insights from across a company’s portfolio or pipeline to optimise overall business processes and outcomes and refine corporate benchmarks.

There are incredible opportunities ahead when you leverage data in construction. In fact, by harnessing data from all the past projects, your organisation will certainly gain a tangible, competitive edge in the decade ahead.

Find out how developers and contractors can build smarter with real-time data.